List of The Best Brokers with a Profit Calculator

Here’s a quick comparison of the top brokers for 2025 that offer built-in profit calculators. These brokers are selected based on their features, ease of use, and market access, making it easier for traders to calculate potential returns.

| Commision | Instruments | Trading Cost | Leverage | ||

|---|---|---|---|---|---|

| From $6 per lot | Commodities Forex Crypto Stocks | From 0.0 pips | Up to 1:500 | ||

| No commission (for Standard accounts) | Forex CFDs Indices Commodities Crypto | From 0.1 pips | Up to 1:1000 | ||

| From $5 per lot | Commodities Currencies Cryptocurrencies ETFs Indices Stocks | From 0.9 pips | Up to 1:400 | ||

| No commission | Forex Stocks ETFs Commodities Crypto | From 1 pip | Up to 1:30 (1:5 for crypto) | ||

| No commission | Commodities Currencies Cryptocurrencies Indices Stocks | From 0.1 pips | Up to 1:2000 | ||

| No commission (for Standard accounts) | Commodities Currencies Cryptocurrencies Indices Stocks | From 0.0 pips | Up to 1:3000 | ||

| From $5 per lot | Commodities Forex Stocks Indices Metals | From 0.2 pips | Up to 1:50 | ||

| From $4 per lot | Energies Forex Cryptocurrencies Stocks Futures Indices Metals | From 0.0 pips | Up to 1:500 | ||

| No commission | Commodities Stocks Forex Indices Metals Shares | From 0.1 pips | Up to 1:1000 | ||

| From $6 per lot | Forex Metals Energies Indices Stocks Commodities Bonds ETFs Cryptocurrencies | From $6 per lot | Up to 1:1000 | ||

| From $3 per lot | Bonds Commodities Cryptocurrencies Stocks Forex Futures Indices | From 0.0 pips | Up to 1:500 | ||

| No commission | Commodities Currencies Cryptocurrencies ETF Indices Stocks Futures Bonds Options | From 0.6 pips | Up to 1:200 | ||

| No commission | Forex Stocks Commodities Crypto Futures Indices Metals | From 0.0 pips | Up to 1:1000 | ||

| No commission on standard accounts | Forex Stocks Cryptocurrencies Commodities Indices Options | From 0.1 pips | Up to 1:1000 | ||

| No commission | Forex Cryptocurrency Commodities Indices Metals | From 0.1 pips | Up to 1:50 | ||

| No commission on standard accounts | Commodities Currencies Cryptocurrencies Indices Stocks | From 0.4 pips | Up to 1:1000 | ||

| No commission | Commodities Energies Stocks ETFs Forex Metals Indices | From 0.0 pips | Up to 1:500 | ||

| No commission | Commodities Forex ETFs Indices Stocks Energies Metals | From 0.0 pips | Up to 1:2000 | ||

| From $2 per lot | Currencies Commodities Indices Bonds ETFs Futures Metals | From 0.0 pips | Up to 1:500 | ||

| No commission | Commodities Energies Stocks Forex Indices Metals | From 0.0 pips | Up to 1:1000 |

Top 10 Brokers with a Profit Calculator

Entering the world of trading can be exciting, but having the right tools is essential. The best brokers for 2025 offer built-in profit calculators, helping traders easily estimate potential returns. These brokers provide intuitive platforms, secure trading environments, and low minimum deposit requirements, making it easy to get started without a large initial investment.

Exness

Summary

Exness stands out for its quick trade execution and tight spreads, making it a top pick for forex traders. With flexible account types and useful tools, it suits both beginners and experienced traders, especially those focused on scalping or automated trading.

- Execution Speed: Orders process in just 0.05 seconds.

- Spreads: Start at 0.0 pips for cost-efficient trading.

- Account Types: Choose between Standard or Raw Spread accounts.

- Leverage: Up to 1:500 for managing risk.

- Tools: Includes Autochartist for market analysis, Myfxbook for trade tracking, and free VPS for stable trading.

Exness delivers lightning-fast trade execution, ultra-low spreads, and diverse account types. It excels for automated trading with free VPS, making it a top choice for scalpers and algo traders. Tools like Autochartist and Myfxbook offer powerful market analysis and performance tracking. Read more.

Pros

- Lightning-fast trades with minimal delays.

- Low spreads starting at 0.0 pips save money.

- Myfxbook support for automated trading.

- Free VPS keeps trading uninterrupted.

- High leverage (1:500) offers flexibility.

- No requotes for reliable trade execution.

Cons

- Limited assets beyond forex.

- Some tools are only available with higher-tier accounts.

FXTM

Summary

- Execution Speed: Trades process in 0.12 seconds.

- Spreads: Start at 0.1 pips on ECN accounts.

- Account Types: Standard, ECN, and Cent accounts for different needs.

- Leverage: Up to 1:1000 for strategic trading.

- Tools: Daily market insights, free VPS, and trade signals for better decisions.

FXTM shines with its beginner-friendly approach, offering tutorials, webinars, and guides to build trading skills. Its variety of accounts and high leverage provide flexibility, while tools like daily insights and free VPS ensure smooth and informed trading.

FXTM is an easy-to-use broker with top-notch learning tools and adaptable trading options. It offers various account types to suit beginners and skilled traders alike. The broker also delivers tight spreads and quick trade execution. Read more.

Pros

- Excellent learning materials for new traders.

- Diverse account options for all experience levels.

- Tight spreads from 0.1 pips on ECN accounts.

- Free VPS for consistent trading performance.

- Daily market updates and signals boost strategy.

- High leverage (1:1000) supports varied trading plans.

Cons

- Limited advanced tools for expert traders.

- Standard accounts have wider spreads.

Tickmill

Summary

- Execution Speed: Average of 0.20 seconds with no requotes.

- Spreads: From 0.0 pips on Raw accounts.

- Account Types: Classic, Raw, and Tickmill Trader Raw accounts.

- Leverage: Up to 1:500 (varies by region).

- Tools: MetaTrader 4/5, Tickmill Trader, Acuity Trading, Signal Centre, and VPS options.

Tickmill offers a straightforward trading experience with competitive costs and platforms like MetaTrader 4 and 5. Its educational resources, including webinars and eBooks, make it ideal for beginners, while low spreads and fast execution attract scalpers and algo traders.

Tickmill is a great pick for forex traders seeking low-cost trading and fast execution. Its $100 minimum deposit and extensive learning materials make it accessible for beginners, while the Raw account’s tight spreads appeal to high-volume traders. However, those wanting a broader range of assets or a modern proprietary platform might look elsewhere. Read more.

Pros

- Tight spreads starting at 0.0 pips on Raw accounts.

- No fees for deposits or withdrawals.

- Fast and reliable trade execution (0.20s average).

- Strong regulation by FCA, CySEC, and others.

- Rich educational content for new traders.

- Supports all trading strategies, including scalping and hedging.

Cons

- Limited asset variety beyond forex (e.g., no ETFs).

- MetaTrader platforms may feel outdated for some users.

Pepperstone

Summary

- Execution Speed: Trades execute in 0.06 seconds.

- Spreads: Start at 0.0 pips on Razor accounts.

- Account Types: Standard and Razor accounts.

- Leverage: Up to 1:500 for flexible strategies.

- Tools: Smart Trader Tools, Autochartist for analysis, and VPS for automation.

Pepperstone excels with its fast execution and low-cost trading, making it ideal for scalping. Smart Trader Tools enhance MetaTrader 4, giving technical traders an advantage. Free VPS supports automated trading, ensuring smooth performance.

Pepperstone is a leading forex broker, perfect for scalpers and high-frequency traders. It offers ultra-low spreads, rapid trade execution, and tools to boost trading performance. Regulated by trusted bodies like ASIC and FCA, it’s a secure option for traders of all levels. Read more.

Pros

- Super-fast trades with spreads from 0.0 pips.

- Great for scalping and high-volume trading.

- No interference, offering direct market prices.

- Smart Trader Tools improve MetaTrader 4.

- Free VPS for automated trading systems.

- Strong regulation ensures trader safety.

Cons

- Limited assets beyond forex and CFDs.

- Razor accounts need a higher deposit.

Oanda

Summary

- Execution Speed: Average of 0.10 seconds with instant execution options.

- Spreads: From 0.0 pips on Eurica accounts; 3–7 pips on Standard accounts.

- Account Types: Standard, Eurica, Cent.Standard, Cent.Eurica.

- Leverage: Up to 1:1000 (varies by region and account).

- Tools: ForexCopy, PAMM system, MT4/MT5 platforms, market analysis, contests.

OANDA is a trusted forex broker, ideal for traders seeking fast execution, competitive spreads, and powerful research tools. Regulated by top authorities like the CFTC, FCA, and ASIC, it offers a secure trading environment. With no minimum deposit and user-friendly platforms, it’s great for both beginners and experienced traders. Read more.

Pros

- Fast trades with 0.05-second execution.

- Competitive spreads from 0.2 pips on forex pairs.

- No minimum deposit, perfect for new traders.

- Advanced tools like Autochartist and TradingView.

- VPS available for automated trading strategies.

- Highly regulated for trader safety.

Cons

- Limited assets beyond forex and CFDs.

- Leverage capped at 1:50 in some regions.

Instaforex

Summary

- Execution Speed: Average of 0.10 seconds with instant execution options.

- Spreads: From 0.0 pips on Eurica accounts; 3–7 pips on Standard accounts.

- Account Types: Standard, Eurica, Cent.Standard, Cent.Eurica.

- Leverage: Up to 1:1000 (varies by region and account).

- Tools: ForexCopy, PAMM system, MT4/MT5 platforms, market analysis, contests.

InstaForex, established in 2007, serves over 7 million traders globally and is regulated by the BVI FSC and CySEC (EU entity). It offers 300+ instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies, with a $1 minimum deposit, making it accessible for beginners. The ForexCopy and PAMM systems allow copying trades or investing passively, while contests and bonuses (up to 100% on deposits) add appeal. However, spreads on Standard accounts are high, and some users report slow withdrawals or verification issues. Customer support is 24/7 but can be inconsistent. Read more.

Pros

Regulated by seven Tier-1 authorities for high trust.

Competitive spreads from 0.2 pips on major forex pairs.

Fast execution (0.05s average) with no requotes.

No minimum deposit, ideal for new traders.

Strong research tools, including Autochartist and daily analysis.

User-friendly platforms with TradingView integration.

Cons

Limited asset variety beyond forex (no ETFs or stocks in some regions).

Spreads higher than top discount brokers like CMC Markets.

Educational content lacks advanced courses or quizzes.

IC Markets

Summary

- Execution Speed: Average of 0.04 seconds (40ms) with no requotes.

- Spreads: From 0.0 pips on Raw Spread accounts (EUR/USD avg. 0.1 pips).

- Account Types: Standard, Raw Spread (MetaTrader), Raw Spread (cTrader).

- Leverage: Up to 1:500 (1:30 in EU/Australia due to regulations).

- Tools: MetaTrader 4/5, cTrader, TradingView, ZuluTrade, Autochartist, VPS.

IC Markets is a leading forex and CFD broker, ideal for scalpers and high-frequency traders due to its ultra-low spreads and fast execution. Founded in 2007 and regulated by ASIC (Australia), CySEC (Cyprus), and FSA (Seychelles), it offers a secure trading environment. With a $200 minimum deposit and advanced platforms, it suits both beginners and pros. Read more.

Pros

Ultra-tight spreads from 0.0 pips, ideal for scalping.

Fast execution (0.04s avg.) with no dealing desk interference.

Wide range of platforms (MT4, MT5, cTrader, TradingView).

No deposit/withdrawal fees; $200 minimum deposit.

Supports all trading styles, including hedging and EAs.

Strong regulation by ASIC, CySEC, and FSA.

Cons

Limited assets beyond forex and CFDs (no real stocks or ETFs).

Educational content lacks quizzes or progress tracking.

Leverage capped at 1:30 in EU/Australia for retail traders.

FXPro

Summary

- Execution Speed: Average of 0.014 seconds (14ms) with no dealing desk intervention.

- Spreads: From 0.0 pips on cTrader Raw accounts; 1.6 pips avg. on Standard accounts.

- Account Types: MT4 Instant, MT4 Market, MT5, cTrader, FxPro Edge.

- Leverage: Up to 1:500 (1:30 in EU/UK for retail; higher for pro clients).

- Tools: Trading Central, Autochartist, VPS, economic calendar, FxPro Squawk.

FxPro, founded in 2006, is a global forex and CFD broker serving over 2 million clients in 170+ countries. Regulated by FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCB (Bahamas), it offers 2100+ instruments, including forex, stocks, indices, commodities, and crypto CFDs. Its platforms—MT4, MT5, cTrader, and FxPro Edge—cater to diverse trading styles, with cTrader excelling for algo trading. The $100 minimum deposit is accessible, but Standard account spreads are wider than competitors. Educational resources are solid, though advanced content is limited. Support is 24/5, responsive via chat, email, and phone. Read more.

Pros

Ultra-fast execution (14ms avg.) with no requotes.

Wide range of platforms (MT4, MT5, cTrader, FxPro Edge).

2100+ instruments across forex, stocks, and crypto CFDs.

Strong regulation by FCA, CySEC, and others.

No deposit/withdrawal fees; commission-free Standard accounts.

VPS and Trading Central for automated and technical trading.

Cons

Standard account spreads (1.6 pips avg.) are high vs. industry leaders.

Limited advanced educational content for experienced traders.

Inactivity fee ($10 one-off, $10/month after 6 months).

No social/copy trading features like eToro.

AvaTrade

Summary

- Execution Speed: Average of 0.07 seconds (70ms) with market execution.

- Spreads: From 0.9 pips (fixed) on major forex pairs; variable spreads from 0.7 pips.

- Account Types: Standard, Islamic, Options, Spread Betting (region-specific).

- Leverage: Up to 1:400 (1:30 in EU/UK for retail clients).

- Tools: AvaTradeGO, MetaTrader 4/5, AvaOptions, DupliTrade, Trading Central.

AvaTrade, founded in 2006, is a global forex and CFD broker regulated by ASIC (Australia), FSCA (South Africa), CBI (Ireland), and others, serving over 1 million clients. It offers 850+ instruments, including forex, stocks, indices, commodities, cryptocurrencies, and unique options trading. The $100 minimum deposit and AvaTradeGO app make it beginner-friendly, while MT4/5 and DupliTrade support advanced traders. Educational content, including videos and articles, is strong for novices but lacks depth for pros. Customer support is 24/5 via chat, email, and phone, with quick responses. Fixed spreads can be high during volatility, and inactivity fees apply. Read more.

Pros

User-friendly AvaTradeGO app for mobile trading.

Wide asset range (850+), including forex, crypto, and options.

Strong regulation by ASIC, CBI, and FSCA.

No commission fees; $100 minimum deposit.

Copy trading via DupliTrade and ZuluTrade.

Rich beginner-focused educational resources.

Cons

Fixed spreads (0.9 pips) higher than raw spread brokers.

Inactivity fee ($50/quarter after 3 months).

Limited advanced education for experienced traders.

No proprietary social trading platform.

Forex.com

Summary

- Execution Speed: Average of 0.05 seconds (50ms) with market execution.

- Spreads: From 0.0 pips on RAW accounts; 0.8 pips avg. on Standard accounts.

- Account Types: Standard, RAW Spread, MetaTrader, STP Pro (institutional).

- Leverage: Up to 1:50 (US/Canada); 1:200 elsewhere (varies by region).

- Tools: TradingView, MetaTrader 4/5, Performance Analytics, Trading Central, VPS.

Forex.com, established in 2001, is a trusted forex and CFD broker under StoneX, regulated by CFTC/NFA (US), FCA (UK), ASIC (Australia), and others. It offers 80+ forex pairs and 4500+ CFDs on stocks, indices, commodities, and cryptocurrencies (where permitted). The $100 minimum deposit (or $10,000 for RAW accounts) suits varied budgets, and platforms like TradingView and MT4/5 cater to all traders. Educational resources, including webinars and articles, are strong for beginners, though advanced content is limited. Support is 24/5 via chat, email, and phone, but response times can vary. Spreads are competitive, but US clients face stricter leverage and asset limits. Read more.

Pros

Competitive spreads from 0.0 pips on RAW accounts.

Fast execution (0.05s avg.) with reliable pricing.

Wide range of platforms (TradingView, MT4/5, proprietary).

Strong regulation by CFTC, FCA, ASIC, and more.

4500+ CFDs, including forex, stocks, and crypto.

Solid educational tools for beginners.

Cons

High minimum deposit ($10,000) for RAW accounts.

Limited leverage (1:50) and assets for US clients.

Inactivity fee ($15/month after 12 months).

Advanced educational content is sparse.

What is Trading Calculator?

Designed for both beginners and experienced traders, this tool makes complex calculations straightforward, helping users plan their trades efficiently. With just a few inputs, traders can determine their lot size, estimate their profit/loss, and calculate additional costs like swap fees.

As the forex market moves rapidly, a trading calculator free of cost ensures that traders make quick, well-informed decisions based on precise data.

Why Use a Forex Trading Calculator?

A trading profit calculator helps traders accurately estimate the financial impact of their trades before execution. By using this tool, traders can:

Having a forex trading profit calculator ensures traders stay in control of their positions, minimizing unnecessary risks.

Key Features of a Forex Trading Calculator

A calculator trading tool like this is especially useful for those who trade with leverage, where understanding margin requirements and risk exposure is critical.

| Feature | Function |

|---|---|

| Margin Calculator | Helps traders determine the amount of capital required to open a trade. |

| Forex Trading Lot Size Calculator | Assists in selecting the appropriate lot size based on risk tolerance. |

| Profit and Loss Calculator | Estimates potential earnings or losses before entering a position. |

| Pip Value Calculator | Determines the value of a single pip movement for different currency pairs. |

| Swap Calculator | Calculates overnight fees for holding trades longer than a day. |

| Currency Converter | Allows traders to see profits and costs in their preferred currency. |

| Real-Time Calculations | Provides instant, up-to-date results based on live market conditions. |

| User-Friendly Interface | Ensures quick input and output without requiring deep financial knowledge. |

How to Use a Trading Calculator for Smarter Forex Trading

A trading calculator is an essential tool for Forex traders looking to plan their trades with accuracy. Whether you’re calculating potential profits, setting stop-loss levels, or determining required margin, a Forex Calculator helps traders make informed decisions without relying on manual calculations.

By using a trading profit calculator, traders can quickly estimate returns, adjust trade sizes, and manage risk more effectively. A forex trading lot size calculator ensures that each position is appropriately sized according to account balance and market conditions.

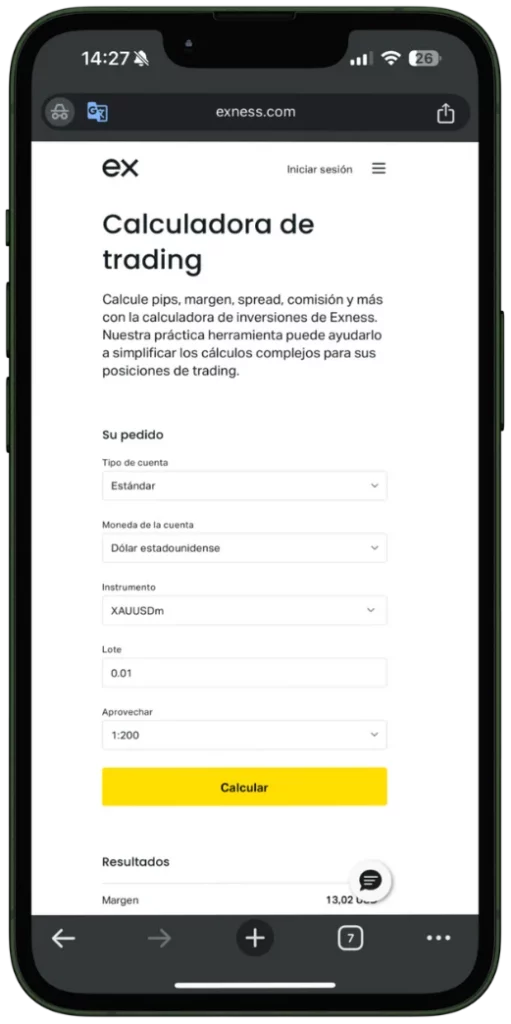

Step-by-Step Guide to Using a Trading Calculator

Using a Forex Calculator is simple and can save traders from costly mistakes. Follow these steps to ensure accurate trade planning:

Access a Trading Calculator Free Online

Most trading platforms and broker websites offer a Forex Calculator free of charge. Some tools are also available as standalone apps or browser-based versions, making them accessible from any device.

Select the Type of Calculation Needed

A calculator trading tool typically includes multiple functions:

| Calculator Type | Purpose |

|---|---|

| Margin Calculator | Helps traders determine how much capital is required to open a position based on lot size and leverage. |

| Pip Value Calculator | Calculates the value of a single pip for different currency pairs, helping with trade sizing. |

| Trading Profit Calculator | Estimates potential profits or losses based on entry and exit prices. |

| Swap Calculator | Computes overnight swap fees for holding positions. |

| Currency Converter | Converts trade values into different currencies for better financial tracking. |

Depending on your trading needs, select the appropriate calculation type before proceeding.

Enter Trade Information

To get accurate results, input the necessary details, such as:

- Currency pair (e.g., EUR/USD, GBP/JPY)

- Lot size (use a forex trading lot size calculator to determine the right amount)

- Leverage (if applicable)

- Entry and exit prices (for profit/loss estimation)

- Buy or sell direction (affects swap fees)

For traders managing multiple positions, using a trading calculator free can simplify tracking performance across different trades.

Calculate and Review the Results

Once all trade details are entered, click the calculate button. The Forex Calculator will provide real-time results, including:

- Required margin for opening the position

- Pip value for determining trade impact

- Potential profit/loss for different exit scenarios

- Swap fees for overnight positions

By analyzing these results, traders can adjust their positions to align with their risk tolerance and strategy.

Apply the Results to Improve Trading Decisions

A trading profit calculator isn’t just a number-crunching tool—it helps traders refine their approach. Based on the results:

- Modify trade size if the margin requirement is too high.

- Adjust stop-loss and take-profit levels according to the calculated pip value.

- Reconsider holding overnight positions if swap fees are too costly.

Using a forex trading lot size calculator ensures traders don’t overexpose their accounts to risk.

Use the Calculator as a Learning Tool

For beginners, experimenting with a Forex Calculator free is a great way to understand the financial side of trading. Adjust different parameters to see how trade size, leverage, and currency pairs affect margin and profit.

Why Every Trader Needs a Forex Trading Calculator

A forex trading profit calculator is more than a convenience—it’s a critical risk management tool. Without it, traders risk miscalculating trade size, which can lead to unnecessary losses.

| Benefit | How It Helps Traders |

|---|---|

| Accurate Trade Planning | Eliminates guesswork by providing precise calculations. |

| Better Risk Management | Helps set stop-loss and take-profit levels based on actual data. |

| Time Efficiency | Speeds up trade preparation with instant calculations. |

| Financial Control | Ensures traders don’t overcommit funds to a single position. |

| Trade Optimization | Allows traders to test different scenarios before entering the market. |

By using a calculator trading tool regularly, traders can make smarter decisions and improve overall trading performance.

Conclusion

A Forex Trading Calculator is one of the most valuable tools a trader can use. Whether calculating margin requirements, pip values, or expected profits, a trading calculator free takes the complexity out of trade planning.

By integrating a trading profit calculator into their strategy, traders can:

- Plan trades with confidence

- Manage risk more effectively

- Optimize trade size using a forex trading lot size calculator

- Save time by automating key calculations

Regardless of experience level, a Forex Calculator free ensures that every trade is based on accurate data, helping traders navigate the market with greater precision.

FAQs

What is a Trading Calculator?

A trading calculator is a tool designed to help traders quickly calculate key financial metrics related to their trades. It can estimate margin requirements, pip values, profit and loss, and swap fees. A Forex Calculator eliminates the need for manual calculations, allowing traders to make informed decisions before placing a trade.